Connect Globally with Trusted Local Payments

With Ahrvo, you can boost customer satisfaction and competitiveness by aligning with local payment preferences and expanding your presence in key international markets.

Streamline Integration

Elevate your business with Ahrvo’s API suite for local payment methods. Integrate a broad selection of regional payment options effortlessly, enabling customers to pay with their preferred methods and creating a smoother, more satisfying transaction experience.

Embrace Instant Payments

Tap into the efficiency of PIX for instant payments in Brazil. Ahrvo’s platform enables you to offer fast, reliable, and secure payment solutions, catering to the growing demand for instant transactions in the Brazilian market.

SEPA and Faster Payments

Offer seamless transactions across the UK and Europe with Ahrvo’s support for SEPA (Single Euro Payments Area) and Faster Payments. Provide your customers with swift, secure, and cost-effective payment options tailored to their regional preferences.

Increase Satisfaction with Local Payment Choices

Enhance customer satisfaction by offering familiar, trusted local payment methods through Ahrvo’s platform. Our seamless and secure transactions improve the user experience, promoting customer loyalty. By enabling preferred payment options, you encourage transaction completion and repeat purchases, showing your commitment to customer needs and building lasting relationships.

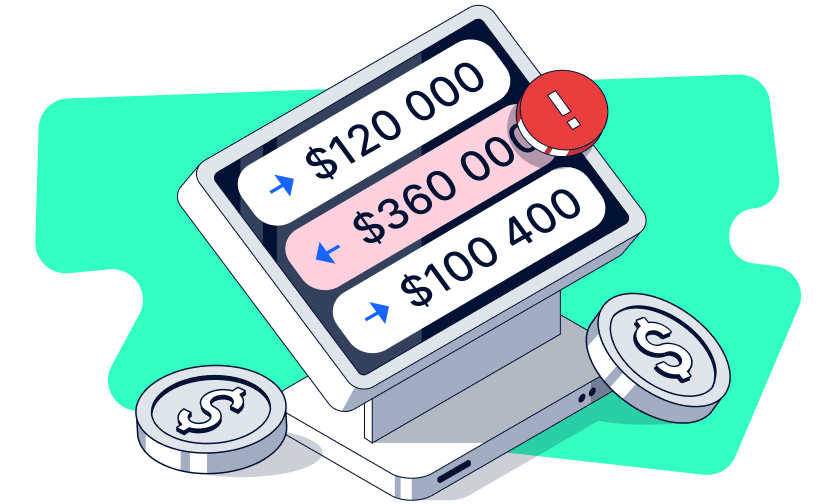

Intelligent Payment Routing

Streamline payment processing with Ahrvo’s intelligent routing algorithms, which optimize transaction flows for speed, cost, and efficiency. Ahrvo’s platform evaluates each transaction to determine the best route, minimizing processing times and lowering transaction costs. This advanced routing not only boosts operational efficiency but also elevates the payment experience for your customers.

Access a World of Payment Methods

Access a diverse range of local payment methods through Ahrvo’s platform, including SEPA, Faster Payments, PIX, and more. With Ahrvo’s extensive support, you can offer the most suitable payment options for customers worldwide. Designed to manage the intricacies of local payments, Ahrvo’s platform provides a seamless, efficient experience for both you and your clients, strengthening your global payment strategy with ease and confidence.

Customize Solutions for Regional Markets

Tailor your payment offerings to meet the unique preferences of each market with Ahrvo’s platform, which supports a wide range of local payment methods. Delivering a personalized and relevant payment experience boosts customer satisfaction and loyalty. By catering to regional preferences, you set your business apart, attract more customers, and drive growth in competitive markets.

Leverage Strategic Partnerships for Local Expertise

Utilize Ahrvo’s vast partner network to deliver comprehensive local payment solutions. Through collaborations with regional financial leaders, Ahrvo provides services tailored to meet the specific needs of your business and customers. These partnerships grant access to advanced payment technologies, helping you stay competitive. By working with trusted local institutions, you offer reliable and efficient payment solutions, strengthening your reputation and building customer trust.

Prioritize Security in Local Transactions

Provide secure and efficient transactions with Ahrvo’s advanced local payment solutions. Ahrvo’s platform upholds high standards of security and compliance, giving customers peace of mind with each payment. Robust security measures protect sensitive data and prevent fraud, ensuring safe transaction processing. By prioritizing security, you build trust and deliver an enhanced payment experience for your customers.

Capture New Markets with Localized Payment Solutions

Broaden your market reach with Ahrvo’s local payment solutions. From SEPA in Europe to OXXO in Mexico, Ahrvo’s platform allows you to cater to a global audience with region-specific payment options. This strategy helps you access new markets and customer segments, boosting revenue potential. By supporting local payment methods, you make transactions seamless for international customers, strengthening your global competitiveness.

Comprehensive Product Stacks for Compliance and Payment Solutions

We understand that businesses have different technological needs and preferences. That’s why we offer a range of product stacks for our compliance and payment solutions, including Native iOS and Android, React Native, React, Angular, and more.

Ahrvo Insights

Understanding Payment Screening: A Comprehensive Guide

The escalating threat of payment fraud poses significant challenges to...

Navigating the FATF Grey List and Blacklist

The Financial Action Task Force (FATF) plays a pivotal role...

Ahrvo Labs Leads the Way in Cross Border Open Banking

Ahrvo Labs is driving the adoption of Cross Border Open...

Safeguarding Your Business: Understanding ACH Fraud and How to Protect Against It

Automated Clearing House (ACH) payments have revolutionized the way businesses...

FAQ

By offering localized payment options, businesses can cater to customer preferences and regulatory requirements, making it easier to enter new markets. Ahrvo’s platform supports a variety of regional payment methods, from SEPA in Europe to PIX in Brazil, helping companies reduce friction and increase conversion rates.

Providing familiar payment options ensures a smoother checkout process for international customers, reducing cart abandonment rates. Ahrvo’s support for diverse local payment methods gives businesses a competitive advantage by meeting customers’ expectations for convenience and familiarity.

Intelligent routing optimizes transaction paths based on factors such as cost, speed, and compliance requirements, ensuring the most efficient processing for each payment. This reduces transaction fees and enhances payment efficiency, allowing businesses to save on operational costs.

A unified platform simplifies compliance by integrating local regulatory requirements directly into the payment workflows. This reduces the need for region-specific adaptations, ensuring consistent adherence to global and local standards while managing payments in various markets.