Maximize payment facilitation with Ahrvo Network’s robust PayFac platform. Streamline merchant onboarding, cut costs, and drive growth with advanced technology and a global network of acquirers.

API Suite for PayFacs

Access a robust set of APIs and SDKs designed specifically for Payment Facilitators. Enable seamless integration with leading acquirers, facilitating secure and efficient payment processing for your sub-merchants.

Effortless Processing

Simplify and expedite merchant onboarding and payment processing with our PayFac solutions. Improve cash flow and reduce transaction fees while catering to a broader sub-merchant base.

Sub-Merchant Management

Streamline sub-merchant management with our adaptable monitoring solution. Offer PayFacs an efficient and cost-effective way to handle transactions, ensuring a user-friendly experience.

Sub-Merchant Experience

Improve your sub-merchants’ cash flow with our seamless payment processing solution. Cater to a wider audience by offering multiple payment options, enhancing the overall user experience. Manage merchant onboarding through your systems or leverage Ahrvo’s suite of business onboarding and client lifecycle management solutions.

Global Payment Network

Gain access to some of the most trusted and innovative payment providers globally through Ahrvo’s Network. Offer your clients a comprehensive suite of payment services, including currency exchange, cross-border payments, mass and bulk payouts, and more. Ahrvo’s partnerships with global leaders ensure you have access to the most advanced and reliable payment solutions available.

Portable Identity Gateway

Experience a streamlined onboarding process with our Portable Identity Gateway. This single onboarding process enables access to a wide range of both technical and commercial financial solutions from our global partner network. One process provides access to over 800+ financial institutions, ensuring quick and easy deployment of financial services.

Transform Payment Operations with Ahrvo’s PayFac Solutions

Optimized Transactions

Optimize transaction flows based on price, settlement, and other factors with Ahrvo Network. Our advanced algorithms help save time and money by routing transactions through the most cost-effective channels while maintaining the highest level of security and compliance. Streamline your transaction processing and improve your bottom line, whether sending or receiving payments.

Fast Market Entry

Ahrvo’s expansive payment and banking network offers a full suite of solutions designed to help PayFacs broaden their reach and fast-track go-to-market efforts. Clients gain access to diverse financial services, from payment processing and card issuance to cross-border payments. Collaborating with global industry leaders, Ahrvo delivers customized solutions that optimize transaction flows to meet your unique requirements.

Seamless Integration

Ahrvo Network enables seamless integration with essential payment functionalities, offering PayFacs a complete solution to manage their operations efficiently. With advanced features from Ahrvo’s partners, sub-merchants can securely process payments, expand their reach, and enhance customer satisfaction. Ahrvo’s platform provides PayFacs with the advantages of a truly global payment solution.

White-Label Solutions

Customize our solutions to meet your specific branding requirements. White-label our platform to create a cohesive experience aligned with your brand identity. Offer a seamless, branded payment experience that reinforces your market position and builds trust with your sub-merchants.

Comprehensive Product Stacks for Compliance and Payment Solutions

We understand that businesses have different technological needs and preferences. That’s why we offer a range of product stacks for our compliance and payment solutions, including Native iOS and Android, React Native, React, Angular, and more.

Ahrvo Insights

Bank Account Check: Strengthening Fraud Prevention and Financial Compliance

Bank account checks, also known as bank account verification, are...

The Challenges of Travel Rule Implementation in the Crypto Industry

In the ever-evolving landscape of the cryptocurrency industry, regulatory compliance...

Currency Transaction Reports: A Cornerstone in the Fight Against Financial Crimes

In the complex landscape of financial transactions, institutions often find...

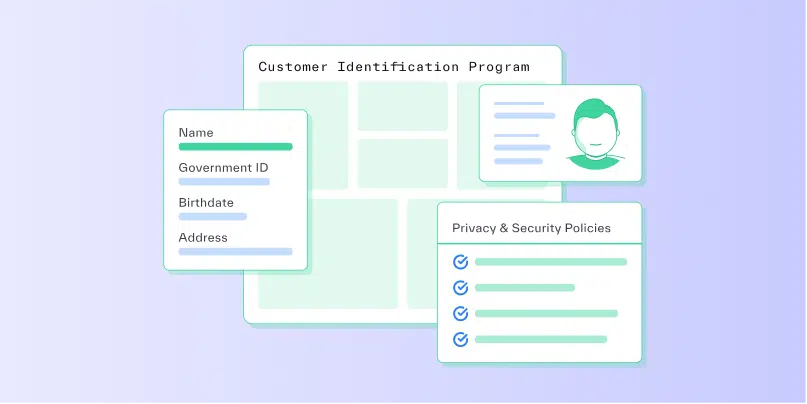

Navigating Customer Identification Program (CIP) Rules for Financial Institutions

Financial institutions stand as frontline defenders against money laundering, a...

Accelerate Growth with Seamless PayFac Integration

FAQ

PayFac solutions allow businesses to quickly onboard sub-merchants and manage transactions at scale through automation. By leveraging Ahrvo’s API suite and adaptable monitoring tools, companies can handle high transaction volumes efficiently without a corresponding increase in operational costs.

Ahrvo’s PayFac solutions simplify compliance by integrating regulatory checks into the onboarding process. The platform supports diverse international regulations, allowing businesses to onboard merchants globally without the need for separate compliance management in each market.

PayFac solutions provide sub-merchants with faster access to funds, customizable payment options, and seamless integration with existing systems. This improves the payment experience for both the merchants and their customers, leading to higher satisfaction and repeat business.

Ahrvo’s platform uses advanced algorithms to route transactions through the most cost-effective channels, taking into account factors such as price, settlement speed, and security. This optimization reduces transaction fees and increases profitability for payment facilitators.