Streamlining Onboarding with Biometric Verification

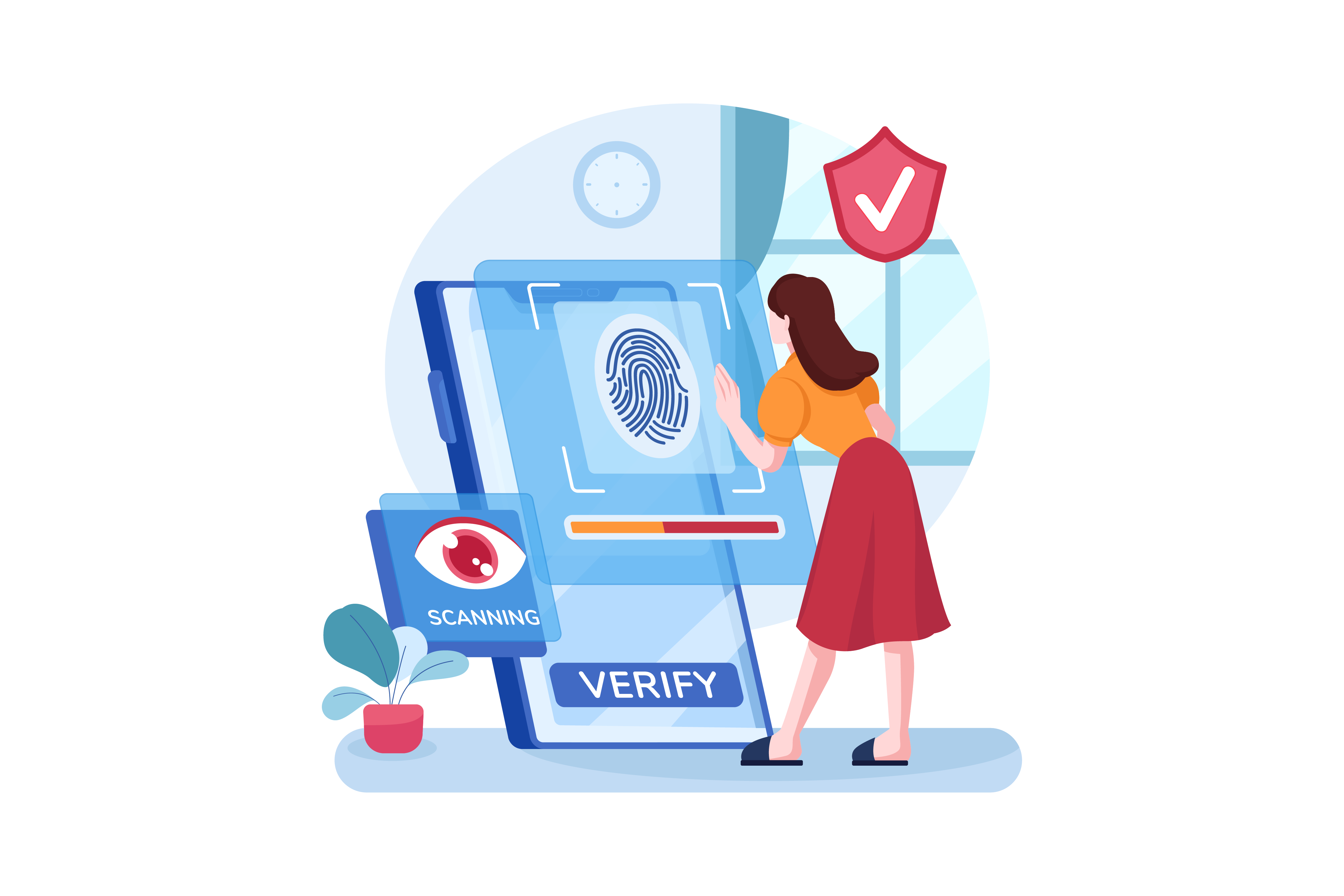

Ahrvo Comply’s biometric verification technology streamlines the onboarding process for financial institutions. By utilizing biometric data, institutions can quickly and accurately verify customer identities, improving the customer experience and reducing fraud. According to a study by Javelin Strategy & Research, biometric verification can reduce fraud rates by up to 70%.

Improved Security

Biometric systems use unique physical characteristics to verify identities, making it difficult for unauthorized persons to access restricted information.

Enhanced Audit Trail

Ahrvo biometric systems provide an audit trail to who accessed what information and when. This makes it easier to detect and prevent fraudulent activity.

Streamlined Compliance

Automated Biometric systems can automate compliance processes, making them more efficient and reducing the risk of human error

Enhancing Security with Biometric Verification Technology

Ahrvo Comply’s biometric verification technology enhances security for financial institutions. By using biometric data, institutions can ensure that customer identities are genuine, reducing the risk of fraud and cyber attacks. According to a report by MarketsandMarkets, the biometric verification market is projected to reach $24.8 billion by 2025.

The Future of Onboarding with Biometric Verification

Ahrvo Comply’s biometric verification technology is shaping the future of onboarding for financial institutions. By using biometric data, institutions can provide a secure and efficient onboarding experience for customers. According to a report by McKinsey, biometric authentication is becoming the norm in financial services due to its speed, accuracy, and convenience.

Automated Biometric Verification for Efficient Onboarding

Ahrvo Comply’s automated biometric verification technology enables financial institutions to streamline their onboarding process. By automating biometric verification, institutions can reduce manual processing and improve operational efficiency. According to a report by Juniper Research, the use of biometric authentication in banking is expected to reach 1.9 billion users by 2021.

Biometric Verification for Enhanced Customer Experience

Ahrvo Comply’s biometric verification technology enhances the customer experience for financial institutions. By providing a seamless and efficient onboarding process, institutions can improve customer satisfaction and retention rates. According to a report by Accenture, 80% of customers are willing to share their biometric data if it improves the security of their financial accounts.

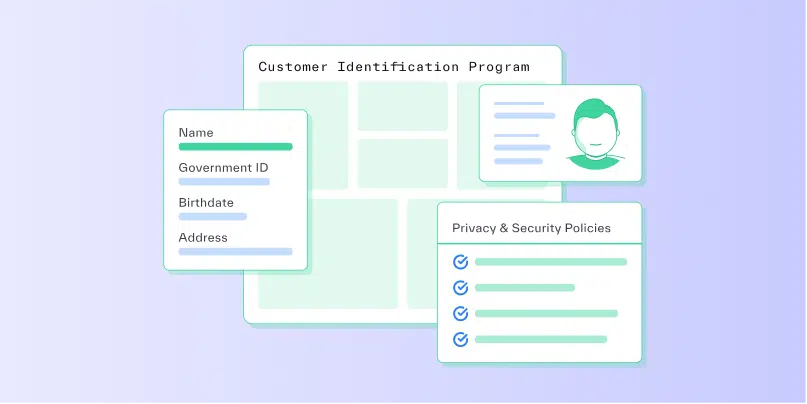

Biometric Verification for KYC Compliance

Ahrvo Comply’s biometric verification technology is an essential tool for financial institutions to maintain KYC compliance. By using biometric data, institutions can ensure that customer identities are genuine and up-to-date, reducing the risk of non-compliance. According to a report by Frost & Sullivan, biometric verification is becoming an integral part of KYC processes in the financial industry.

Biometric Verification for Fraud Prevention

Ahrvo Comply’s biometric verification technology is an effective tool for financial institutions to prevent fraud. By using biometric data, institutions can verify that customers are who they claim to be, reducing the risk of identity theft and fraudulent activities. According to a report by Experian, biometric authentication can reduce fraud rates by up to 90%.

Biometric Verification for Operational Efficiency

Ahrvo Comply’s biometric verification technology improves operational efficiency for financial institutions. By automating the verification process, institutions can reduce manual processing and increase productivity. According to a report by The Nilson Report, biometric authentication can reduce the average call time for customer support by up to 45 seconds.

Comprehensive Product Stacks for Compliance and Payment Solutions

We understand that businesses have different technological needs and preferences. That’s why we offer a range of product stacks for our compliance and payment solutions, including Native iOS and Android, React Native, React, Angular, and more.

Ahrvo Insights

Maximizing KYC and AML Effectiveness with AI Technology

In the ongoing battle against financial crime, banks must leverage...

Benefits of Cross Border Open Banking for International Transactions

As more businesses operate globally, conducting international financial transactions has...

Navigating Customer Identification Program (CIP) Rules for Financial Institutions

Financial institutions stand as frontline defenders against money laundering, a...

Understanding the Foreign Sanctions Evaders (FSE) List: A Comprehensive Guide for Compliance

In the complex landscape of international sanctions, the Foreign Sanctions...

FAQ

Ahrvo Comply’s biometric verification utilizes unique physical characteristics, such as facial recognition, fingerprint scanning, or voice recognition, to verify the identity of an individual. This enhances security measures and ensures that the identity of the person being verified matches the person who is attempting to access the service.

Biometric verification improves the customer onboarding process by providing a fast and seamless experience. Instead of manually entering personal information, customers can simply provide their biometric data, such as a facial scan or fingerprint, to verify their identity quickly and easily.

Ahrvo Comply’s biometric verification is secure and protects customer data using advanced encryption techniques. Biometric data is encrypted and stored securely to prevent unauthorized access.

Ahrvo Comply’s biometric verification complies with regulatory requirements by adhering to industry standards for data privacy and protection. Our solutions are designed to meet regulatory requirements, such as GDPR and CCPA, to ensure the protection of customer data.