- Once Money Becomes Programmable, Identity Must Follow

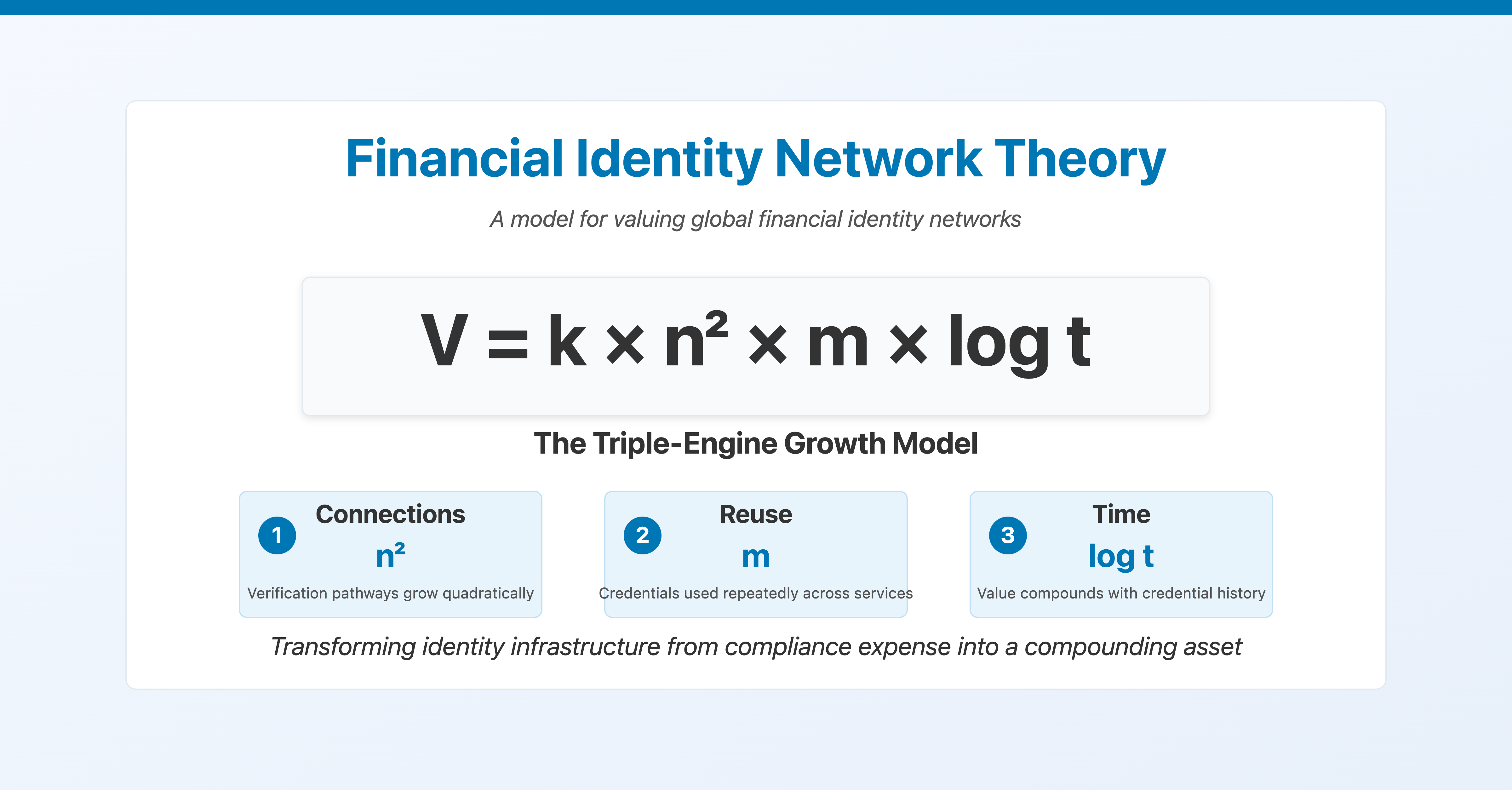

Executive Summary:This podcast analyzes a source arguing that a global financial identity network, where individuals and businesses have cryptographically-bound, reusable identities, could be the most valuable platform since the internet. The current system relies on fragmented, siloed identity verification processes, leading to significant hidden costs in fees, delays, and abandonment rates. A unified network, by verifying identity once and allowing multiple reuses, would transform compliance from an expense into a compounding asset. This network's value is projected to grow exponentially, driven by three key factors: connections, transaction reuse, and temporal data depth, far exceeding traditional Metcalfe's Law predictions. The first entity to achieve meaningful scale in this space is positioned to become a foundational protocol layer for trust in the financial system, similar to TCP/IP for the internet. Learn more at https://ahrvo.com This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit ahrvo.substack.com

- How Partners Use the Ahrvo Network to Launch, Grow, and Monetize Financial Services

This podcast reviews excerpts detailing the Ahrvo Network's infrastructure and various partnership models. The core proposition of the Ahrvo Network is to provide a unified identity, document, and transaction management stack that enables partners to rapidly launch, grow, and monetize financial services globally, navigating increasing regulatory complexity and demand for speed in an API-driven ecosystem. The podcast highlights four key partnership models: Referral, Reseller, White-Label, and Program Manager, each offering distinct levels of engagement, control, and revenue potential. The provided market data underscores the significant growth in both the RegTech and embedded finance markets, suggesting a strong opportunity for platforms like Ahrvo that can streamline payment, banking, and compliance. Learn more at https://ahrvo.com This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit ahrvo.substack.com

- Trust Networks: Rebuilding Banking and Payments With Portable Identity and Stablecoins

Executive Summary:This podcast reviews the main themes and important ideas presented in "Trust Networks," which posits that the convergence of digital identity (specifically Self-Sovereign Identity - SSI), stablecoin-powered payments, and modernized digital banking platforms is poised to revolutionize the global financial landscape by 2025. The report argues that these technologies, when integrated, will enhance security, reduce costs, improve efficiency, expand financial inclusion, and foster innovation. The central concept is the creation of a composable and unified financial ecosystem where portable and reusable digital identities act as the bedrock of trust, enabling seamless and secure interactions across various financial services. Learn more at https://ahrvo.com This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit ahrvo.substack.com

- From If-Then to Intelligent: Comply AI and the Agentic Architecture Behind Ahrvo Network

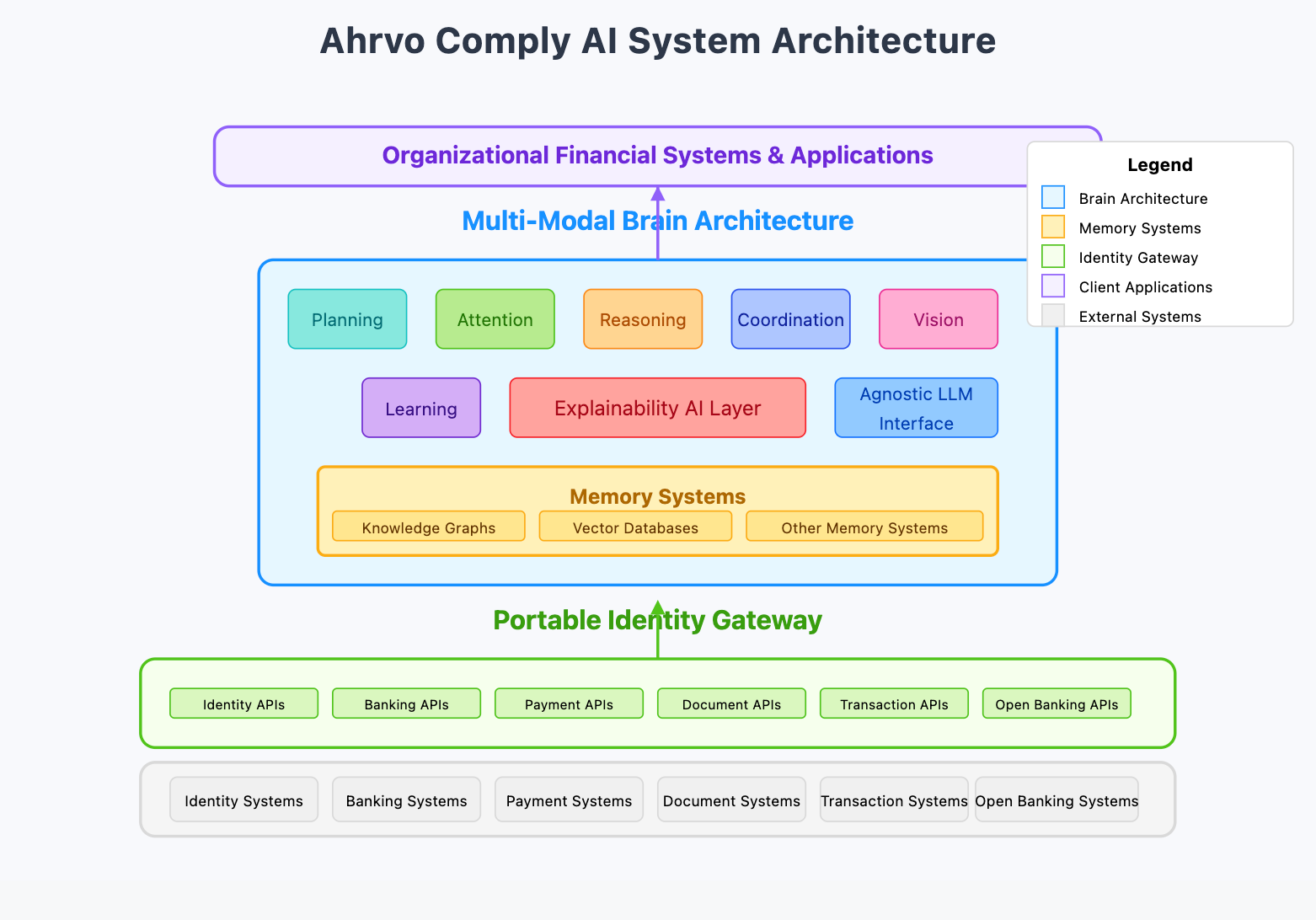

Executive Summary:This podcast reviews Ahrvo Network's Comply AI, an AI-powered agent platform designed to revolutionize financial compliance. The podcast highlights the core problem Comply AI aims to solve: the inefficiency and fragmentation within the current financial compliance landscape. It details the platform's innovative "multi-modal brain architecture" and key cognitive capabilities, emphasizing its vendor-agnostic nature and focus on transparency through its Explainability AI Layer. Furthermore, it explores the underlying technology, including knowledge graphs and vector databases, and underscores the operational advantages and future-proofing capabilities of Comply AI. Ultimately, Comply AI positions itself as a solution that transforms compliance from a burden into a strategic advantage by automating workflows, enhancing efficiency, reducing risks, and seamlessly integrating with existing infrastructure. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit ahrvo.substack.com

- The $6.7M Mistake You Don’t Have to Make

Executive Summary:This podcast reviews the main themes and important ideas presented in "The $6.7M Mistake You Don’t Have to Make," which argues that fragmented financial infrastructure, particularly in compliance onboarding, imposes a significant "fragmentation tax" on businesses. This tax manifests in increased engineering resources, higher compliance costs, longer time-to-market, substantial reconciliation overhead, and limited innovation capacity. The paper highlights the considerable financial cost of manual intervention in fragmented compliance processes, estimating a potential loss of $6.7 million annually for a typical setup. It proposes a fundamentally different approach centered around a "Portable Identity Gateway" and a unified network (Ahrvo Network) that enables one-time business onboarding, a single integration point for various financial partners and services, and a financial marketplace. This unified infrastructure aims to transform compliance from a bottleneck to a growth engine, enabling faster market expansion, turning compliance into a potential revenue center, radically accelerating product launches, unifying data, and creating a sustainable competitive advantage. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit ahrvo.substack.com